Time Series Analysis#

Agenda#

Introduction

ARIMA-Family

TSA Decomposition

Smoothing

Fancy models

What is a Time Series?#

A series of data points over time

Q: Examples

What is a Time Series?#

A series of data points over time

Q: Which is a time series?

average monthly temperatures 1980-2021

average sales of sneakers in January 2021

the latest song by Billie Eilish

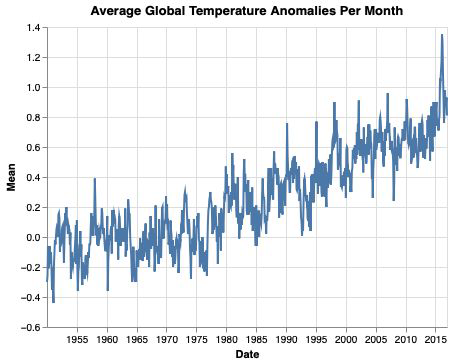

Some temperature data#

Date |

Mean |

Year |

Month |

|

|---|---|---|---|---|

794 |

1950-10-06 |

-0.20 |

1950 |

10 |

795 |

1950-09-06 |

-0.10 |

1950 |

9 |

796 |

1950-08-06 |

-0.18 |

1950 |

8 |

797 |

1950-07-06 |

-0.09 |

1950 |

7 |

798 |

1950-06-06 |

-0.06 |

1950 |

6 |

799 |

1950-05-06 |

-0.12 |

1950 |

5 |

800 |

1950-04-06 |

-0.21 |

1950 |

4 |

801 |

1950-03-06 |

-0.06 |

1950 |

3 |

802 |

1950-02-06 |

-0.26 |

1950 |

2 |

803 |

1950-01-06 |

-0.30 |

1950 |

1 |

What is special in time series data?#

It can (needs to) be ordered by time

Actual values depend on historical ones

Dependent variable stands on both sides of the equation

Even the error terms can depend on historical values

85% of today’s temperature can be explained by yesterdays!

What is special in time series data?#

It can (needs to) be ordered by time

Actual values depend on historical ones

Dependent variable stands on both sides of the equation

Even the error terms can depend on historical values

Distributions can change over time

non-stationarity (hard)

Predicting the future… mhm#

We have no way of knowing (or seriously guessing for that matter) the next outcome of a random experiment. But there is some stuff that we can do!

Pry all information from our data that is not random, and make forecasts from that. Ideally, the remaining error should only be white noise.

Job of a good TSA

split the systematic and the unsystematic

identify both

forecast the systematic

define the unsystematic

EDA for Timeseries#

Visualization#

Visualization is the most important (EDA) tool

Gives a good impression of stylized facts

Trends and/or cycles?

Are there missing values? Are there patterns in missing values?

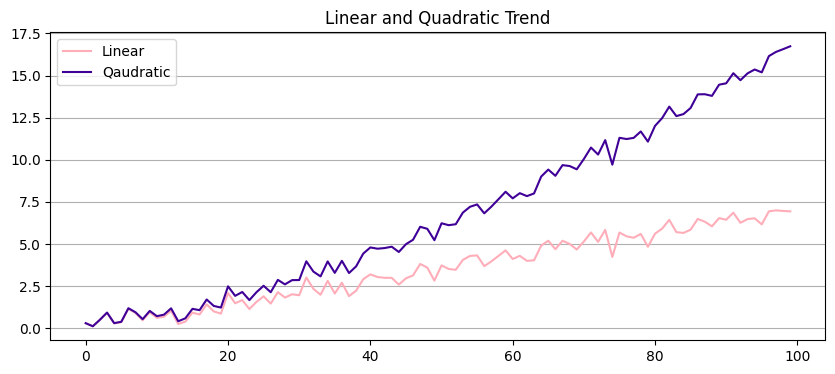

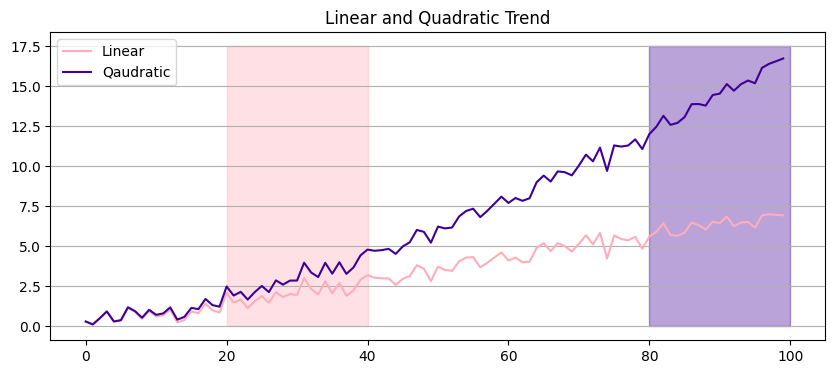

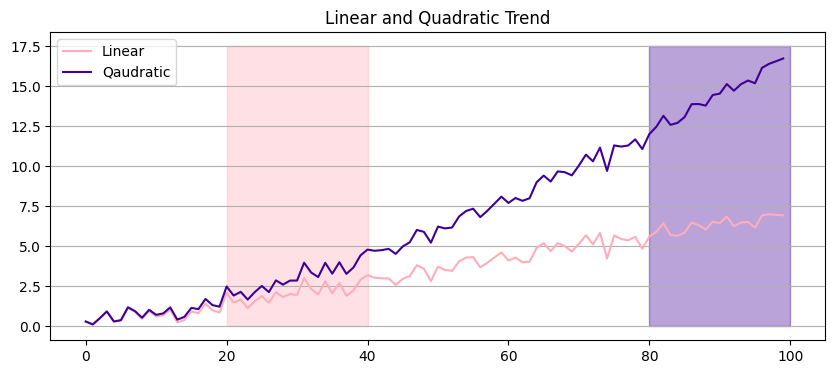

Trends#

Trends are long-term information

Long-term tendency of values

Can show any non-cyclical behavior (linear, quadratic)

Difficulty from trends

Visualizing short-/mid-term is masked)

Modelling the values at different time intervals have different levels

Distribution is time-dependent

Values in x=[20-40] have very different values from values in x=[80-100]

Eliminating trends#

How to eliminate trends?

Model + subtract trends

linear \( m_t = \alpha_0 + \alpha_1 t \)

quadratic \( m_t = \alpha_0 + \alpha_1 t + \alpha_2 t^2 \)

Differencing \(\Delta y_t = y_t - y_{t-1}\)

(High-Pass Filtering: e.g. Hodrick-Prescott)

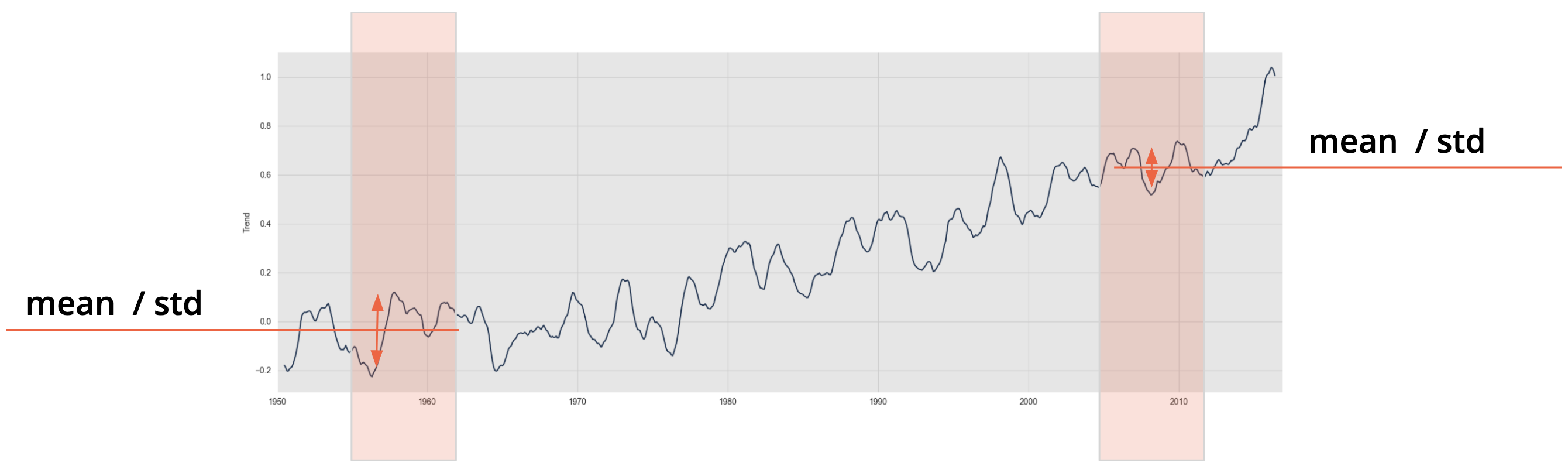

Time series before and after eliminating the trend: afterwards short-/mid-term patterns are clearer

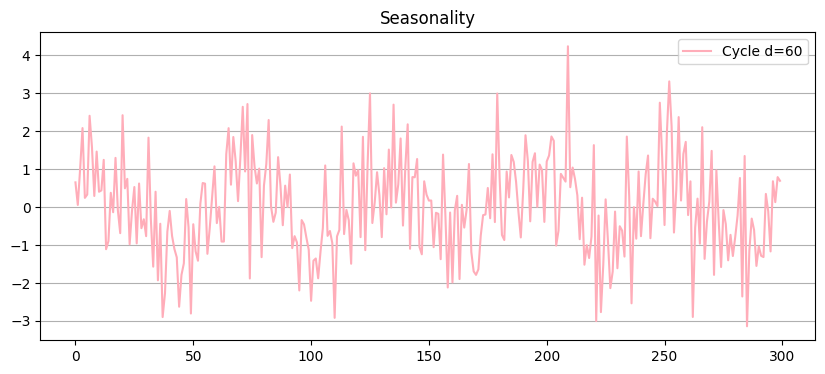

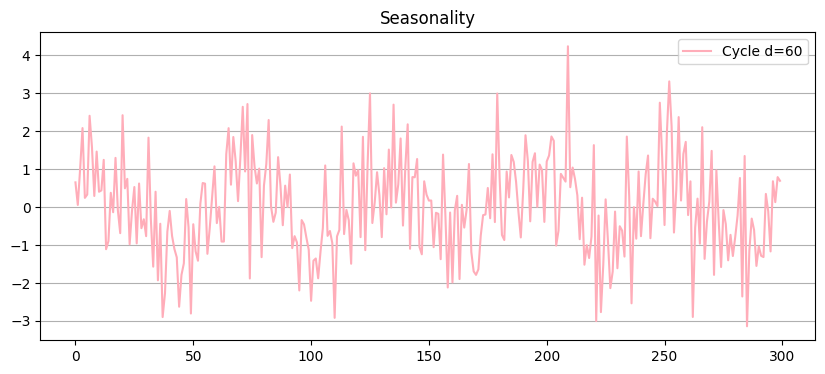

Cycles - and on and on it goes#

Seasonal patterns (cycles) are mid-/short-term information

Recurring value levels

Typical example: sales during the year

Can show any cyclical behavior(e.g. Trigonometric)

Problematic in time series modeling

Values in different areas of the cycle are significantly different

Different distribution - non-stationary

Value distributions look different at different time ranges

Eliminating cycles#

Cycles often contain process-intrinsic information

Eliminate cycles with

Model + subtract trends

Time differencing: \(\Delta y_t = y_t - y_{t-4}\)

Low-pass filtering

Fourier series:

\( s_t = \beta_0 + \sum_{j=1}^{k} (\beta_j \sin(\lambda_j t) + \kappa_j \cos(\lambda_j t))\text{, }\lambda_j = \frac{2\pi}{d_j} \)

Time series before and after removing trend and seasonal patterns… what a beauty

Recap:#

We talked about timeseries data:

Data were the sequence plays a crucial role

Typically: data with a fixed interval without missing values

We talked about visual EDA:

Trends (Where are they coming from? how to deal with that?)

Cycles (Many examples, what to do with that?)

Triggerwarning#

Timeseries?#

DON’T PANIC#

Common Tools in TSA#

Data#

Imputation#

filling (backfilll,forwardfill,mean)

interpolate / filtering

Resampling

Predicting

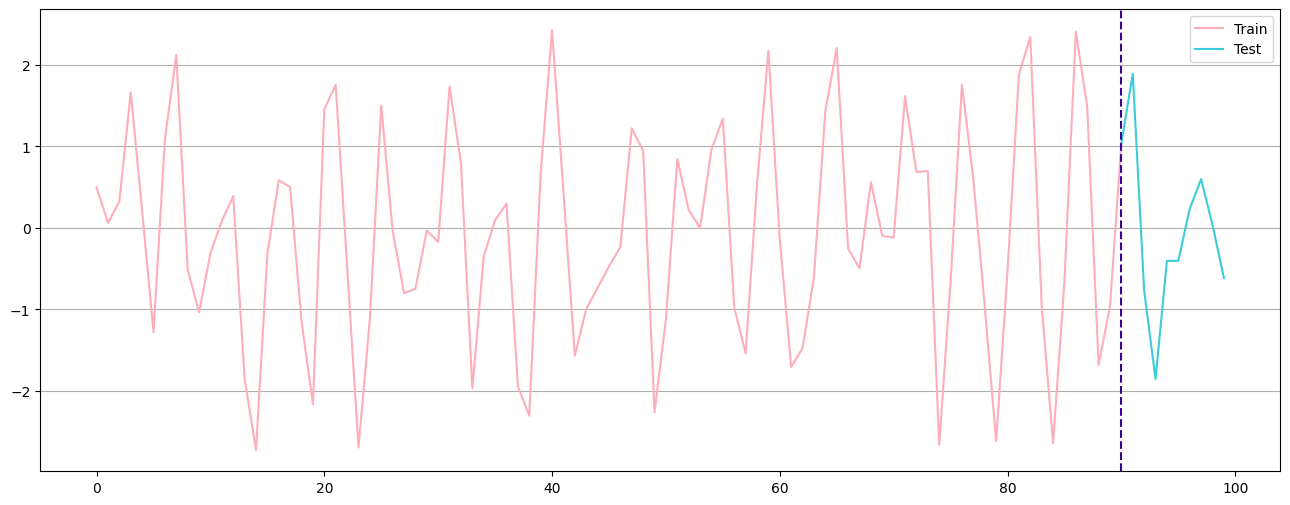

Train - Test - Split#

Q: How would you split a Timeseries?

Train - Test - Split#

Q: How would you split a Timeseries?

train,test = data[:-10],data[-10:]

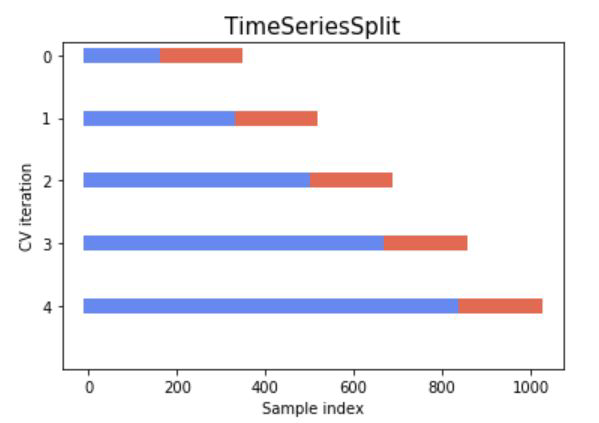

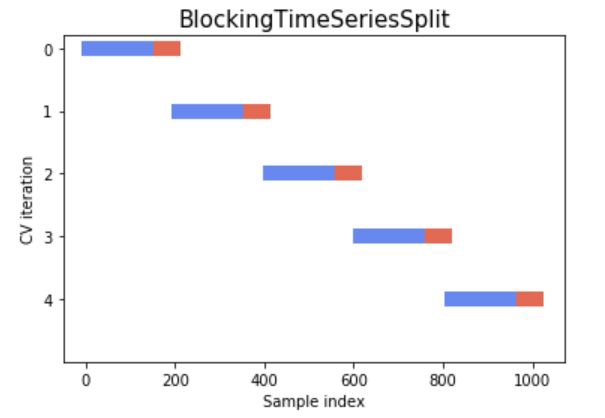

Crossvalidation#

Stationarity#

What does it mean for a TS to be stationary?#

Having a constant mean and covariance function across the time series - in short: constant moments

A time series needs to be stationary in order to make good predictions

How do we know?

ADF test - Null Hypothesis: Not Stationary

KPSS test - Null Hypothesis: Stationary

We can also look at the autocorrelation function ACF

Rolling Mean#

Carefull: This rolling mean is actually an AR(p) process, not a MA(q)

Exponential Smoothing Methods#

Modelling Time Series#

The oldschool stuff - Decomposition#

What makes a time series?#

A simple additive decomposed model

\(m_t\) is the trend

\(s_t\) is the seasonality

\(e_t\) is the error or random noise

Trend -> increase or decrease of the values in the series

Seasonality -> the repeating short term cycles in the series

Random noise -> random variation in the series though there might also be some autocorrelations that can be discovered?!

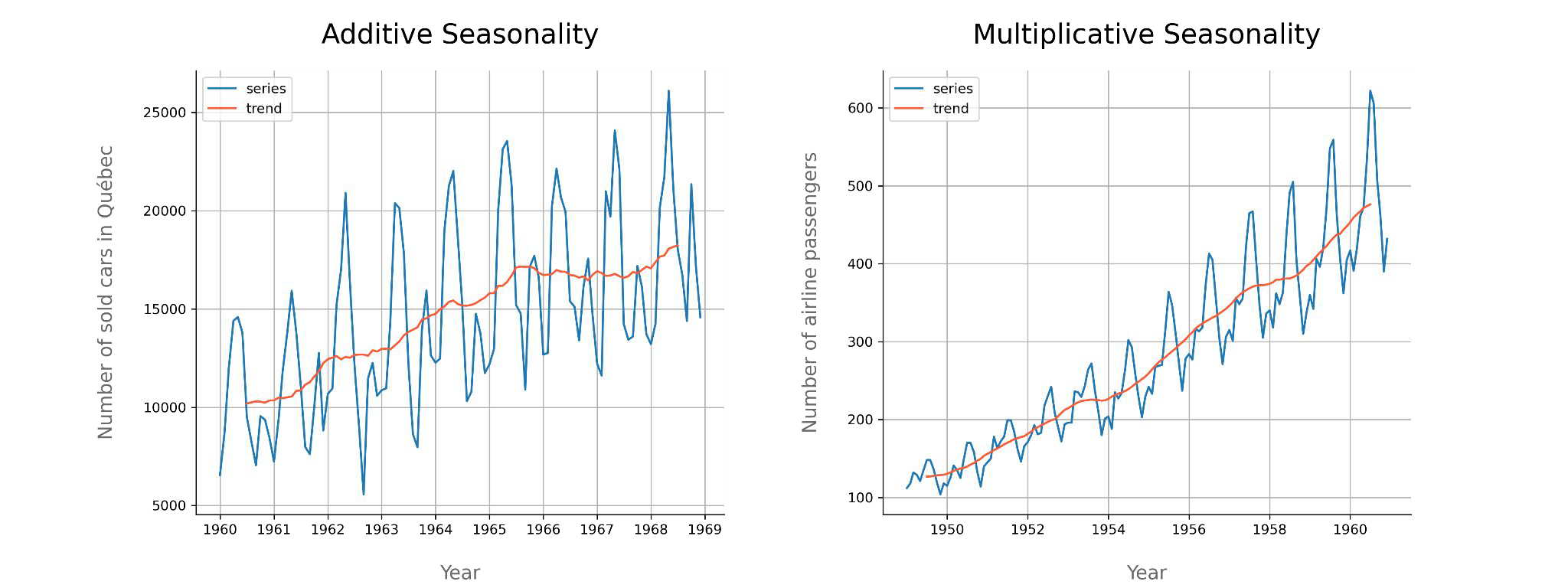

Additive vs Multiplicative#

Components of TS#

Signal#

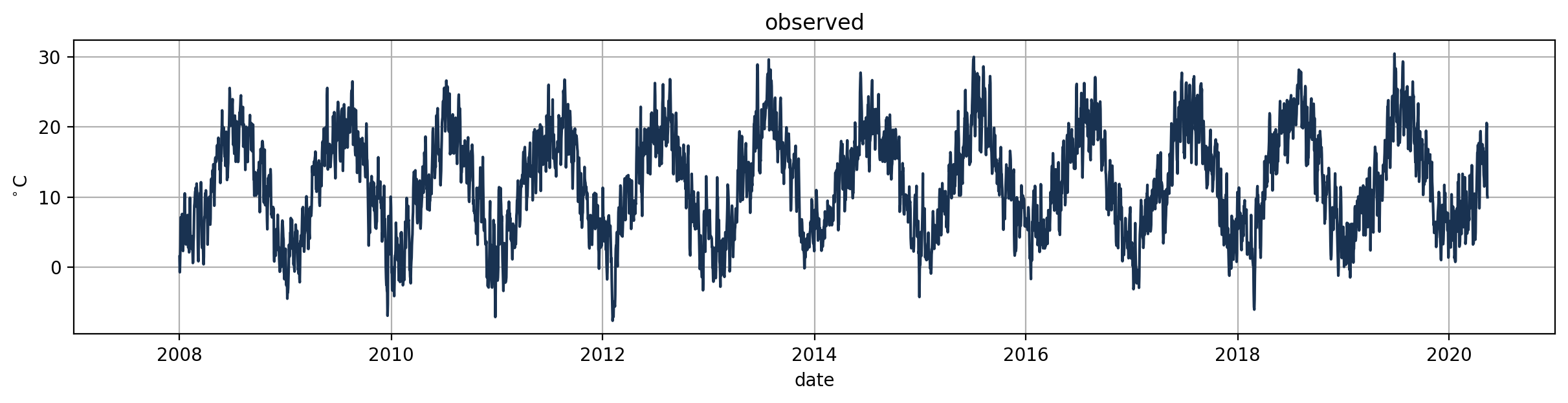

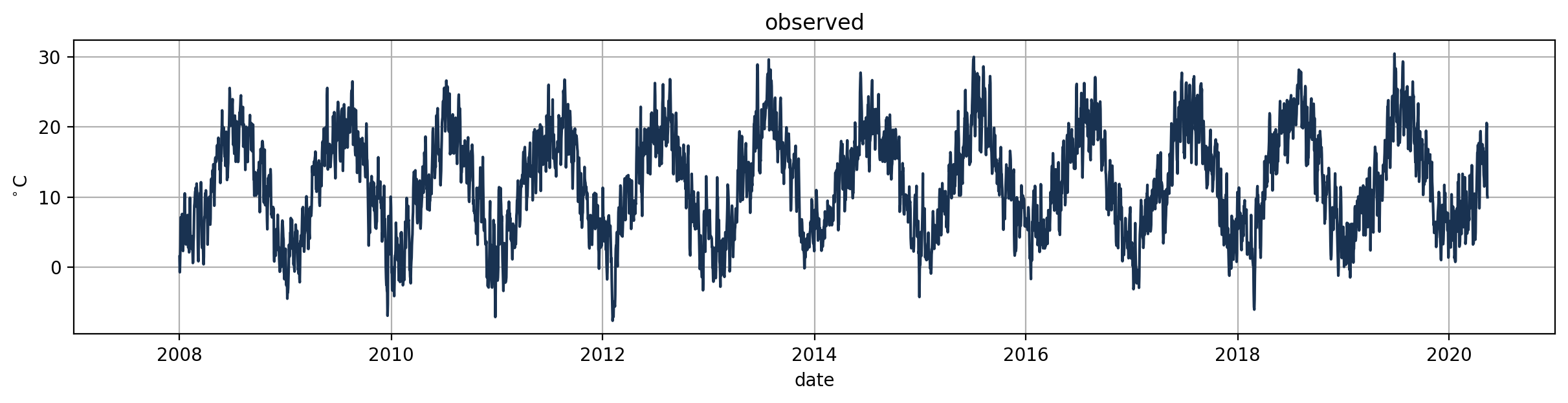

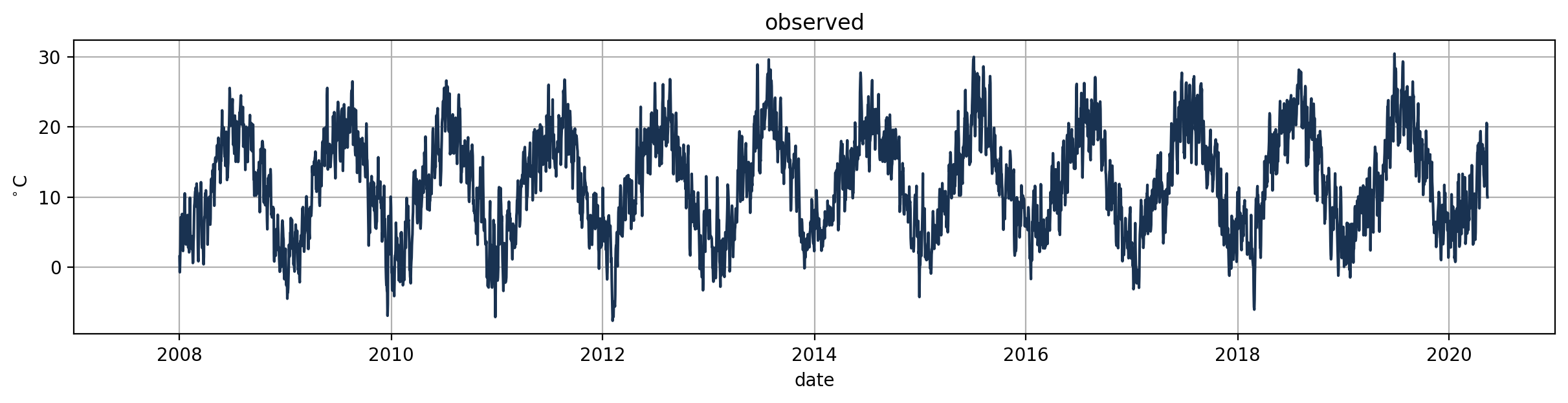

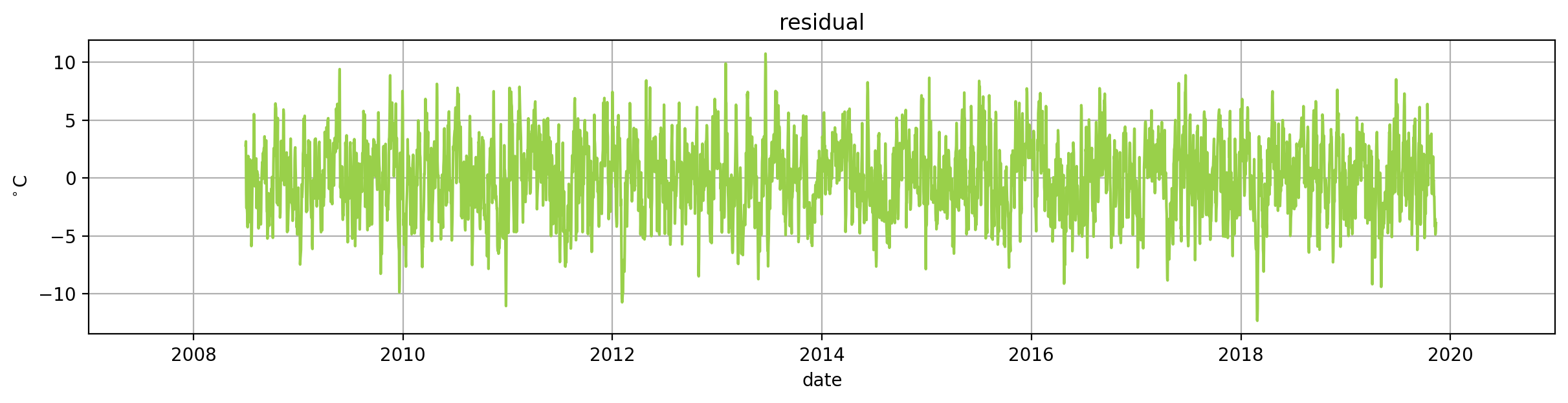

Temperature measurements in Basel

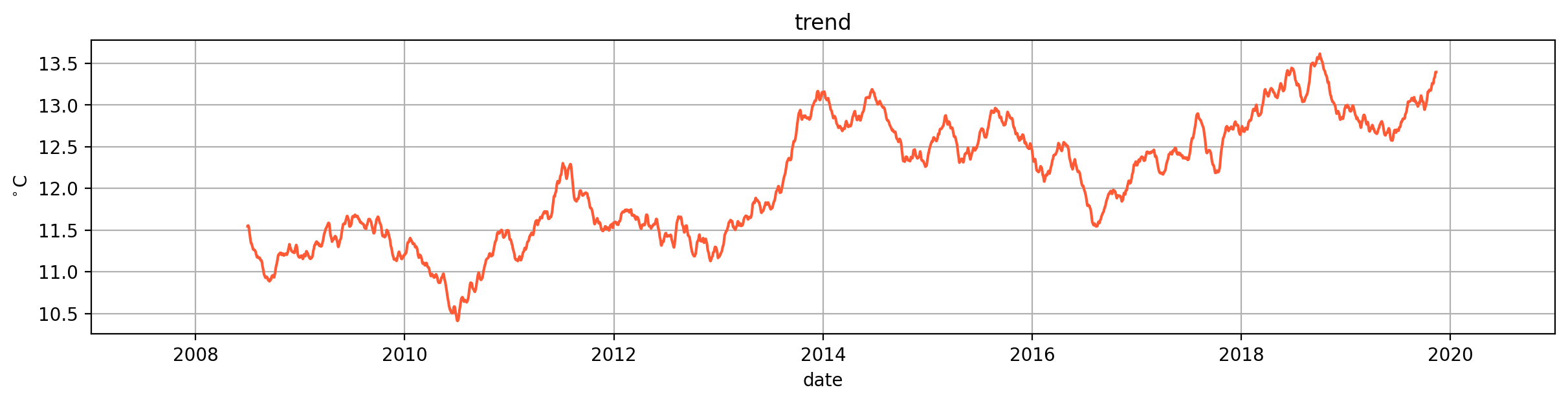

Trend#

What does the trend look like for the temperatures?

(strong) upward trend

temperature is gradually rising

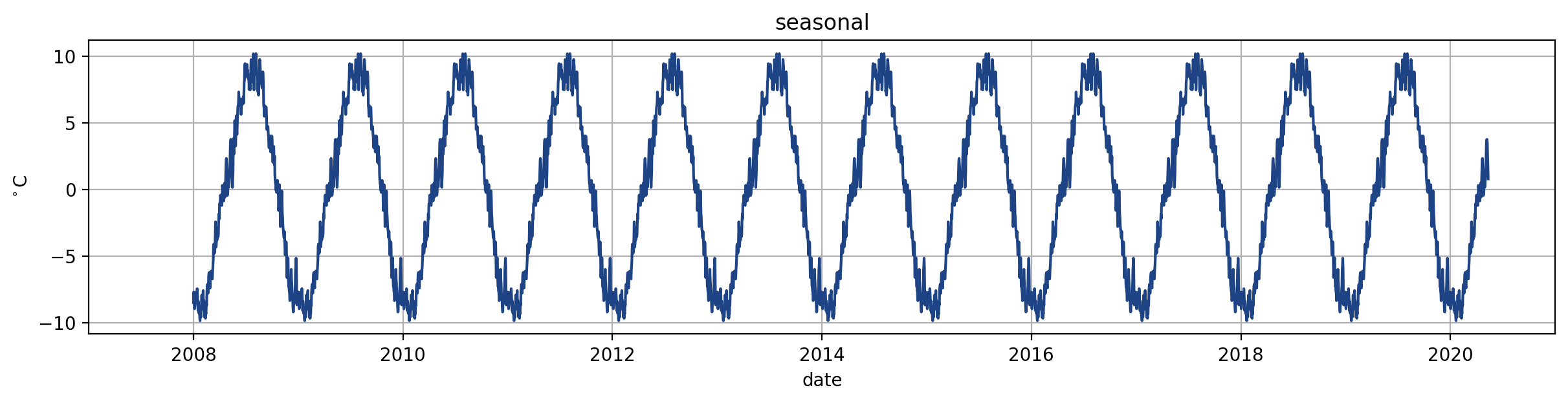

Seasonality#

What does the seasonality look like for the temperatures?

We see a strong seasonality for summer and winter

in business cycles we have the problem of very long cycles - so very long persistence

Residuals#

We want residuals to look random

it is random looking

it shows the variation in the series

unexplained variance happening due to chance

Components of TS#

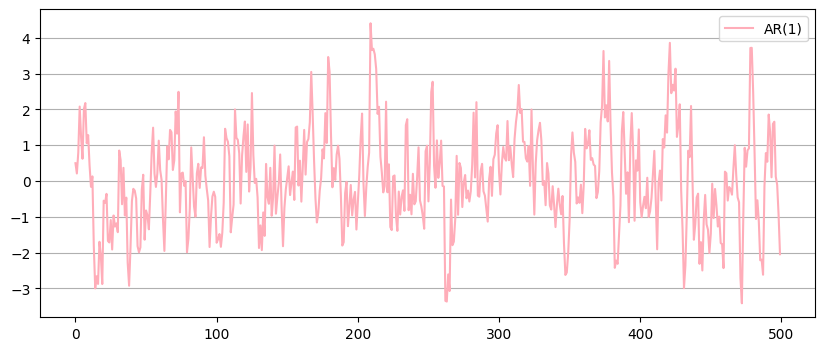

The oldschool stuff - ARMA#

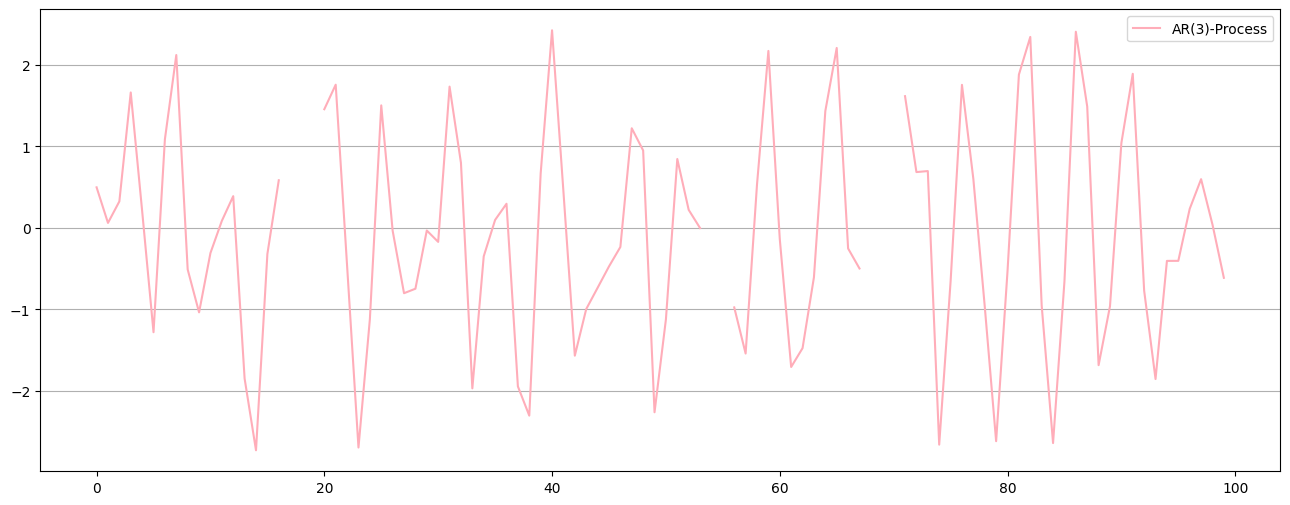

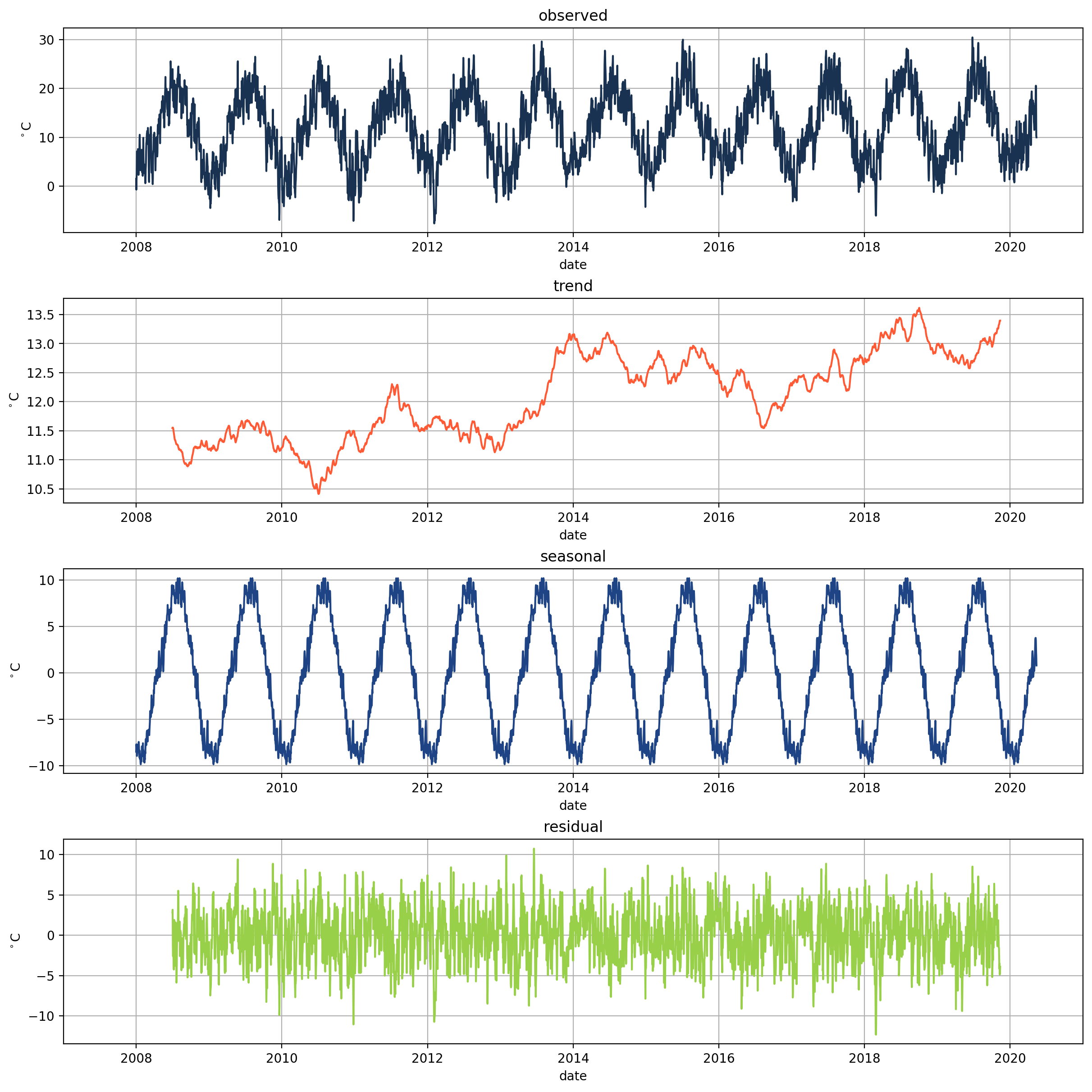

Data Generating ARMA process example#

Store

Current stock of cake \(\hspace{0.5cm}X_t\)

Production

About 100 cakes are produced every day \(\hspace{2cm}\varepsilon_t\)

(normally distributed)

Thieves!

15% of the cakes from stock

are eaten by Larissa

Sales

40% of the production are picked up

the next day

20% of the production are picked up

the day after

Data Generating ARMA process example#

Store

Current stock of cake \(\hspace{0.5cm}X_t\)

Production

About 100 cakes are produced every day \(\hspace{2cm}\varepsilon_t\)

(normally distributed)

Thieves!

15% of the cakes from stock

are eaten by Larissa

Sales

40% of the production are picked up

the next day

20% of the production are picked up

the day after

\(X_t = \underbrace{0.85 X_{t-1}}_{\text{AR(1)}} \underbrace{- 0.2\varepsilon_{t-2} - 0.4\varepsilon_{t-1}}_{\text{MA(2)}} + \varepsilon_t\)

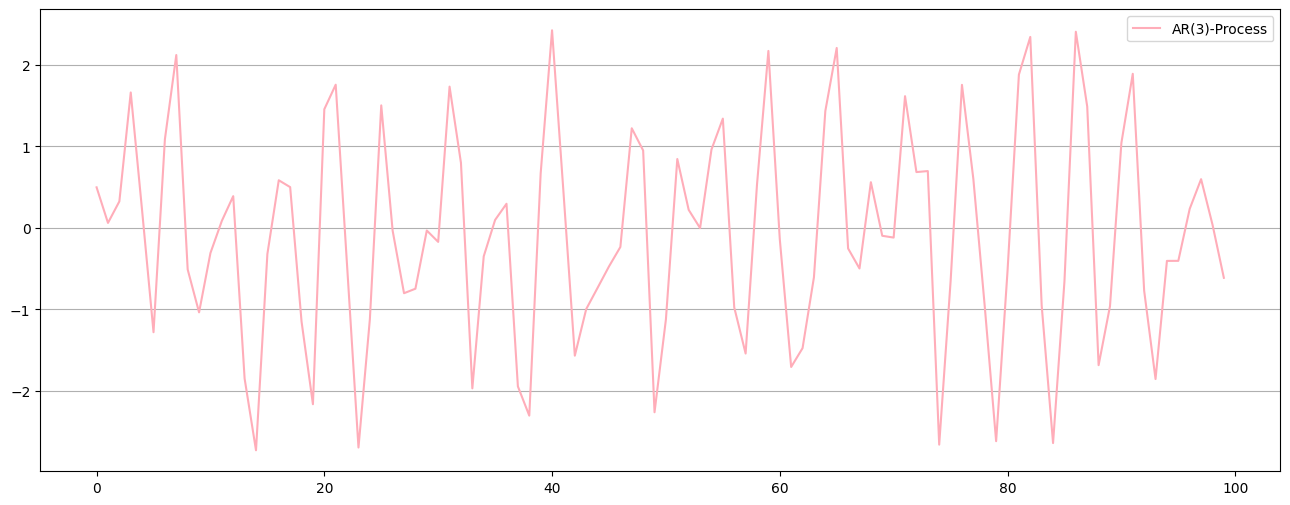

Data Generating ARMA process example#

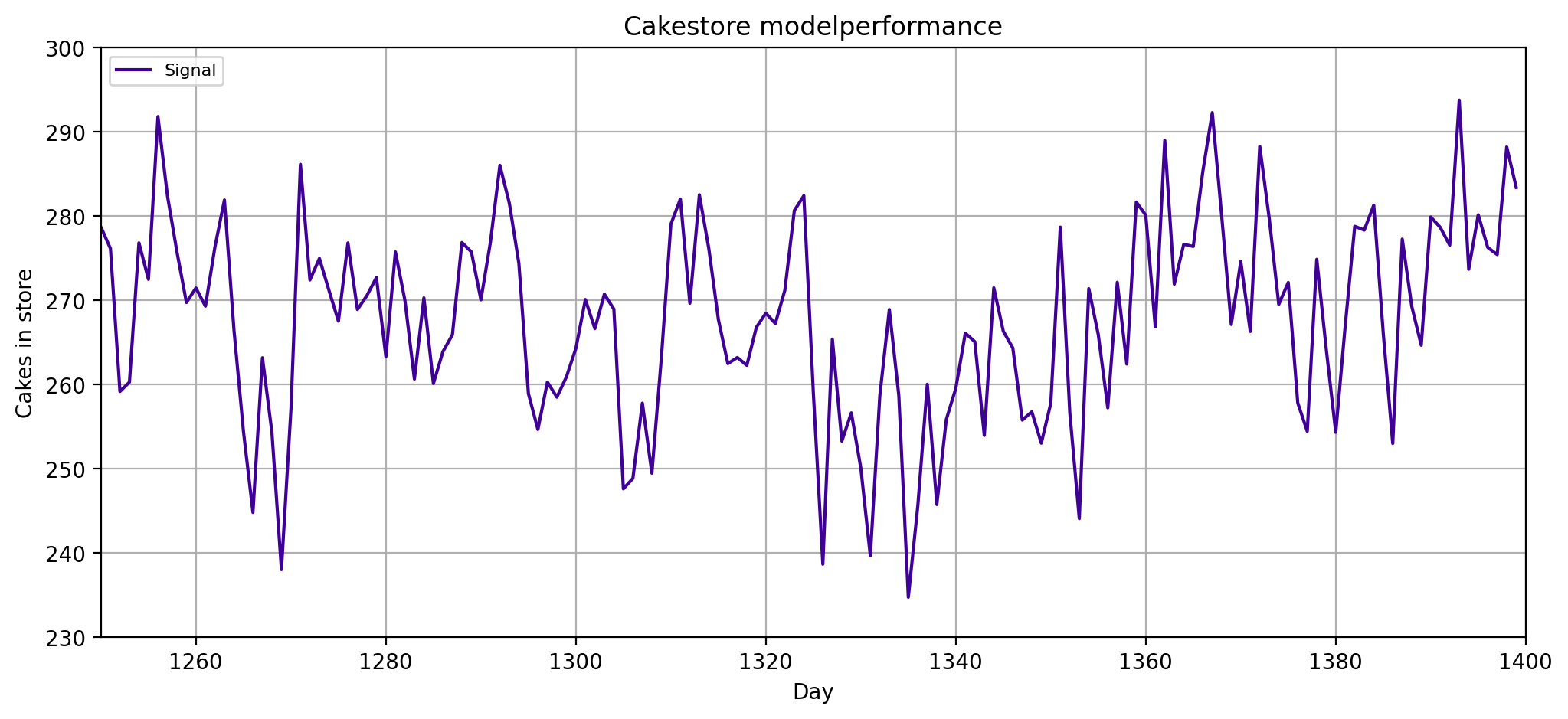

\(X_t = \underbrace{0.85 X_{t-1}}_{\text{AR(1)}} \underbrace{- 0.2\varepsilon_{t-2} - 0.4\varepsilon_{t-1}}_{\text{MA(2)}} + \varepsilon_t\)

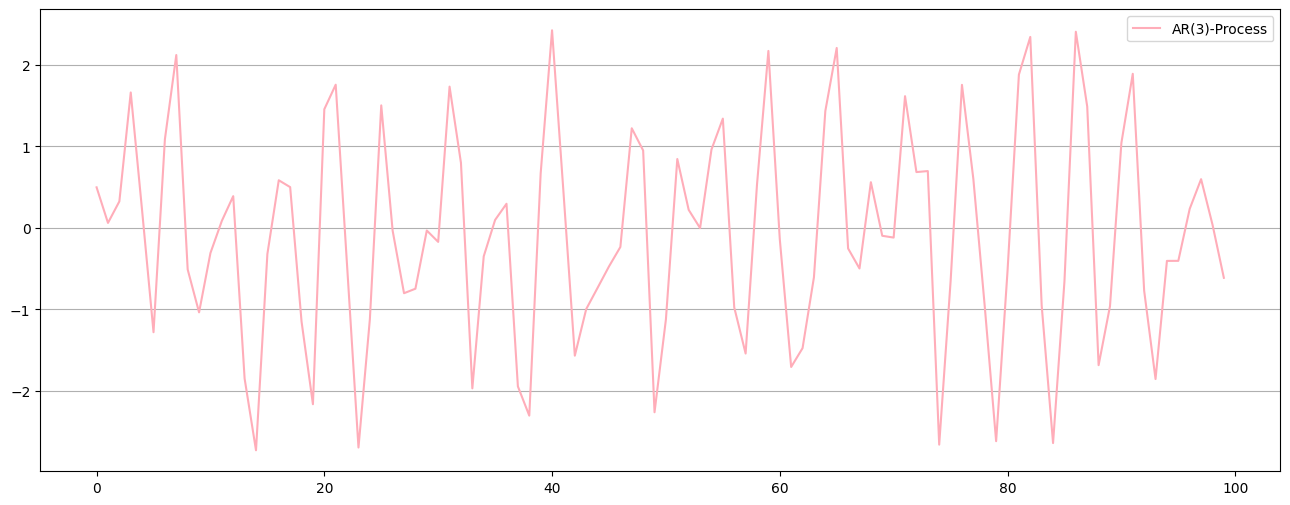

Data Generating ARMA process example#

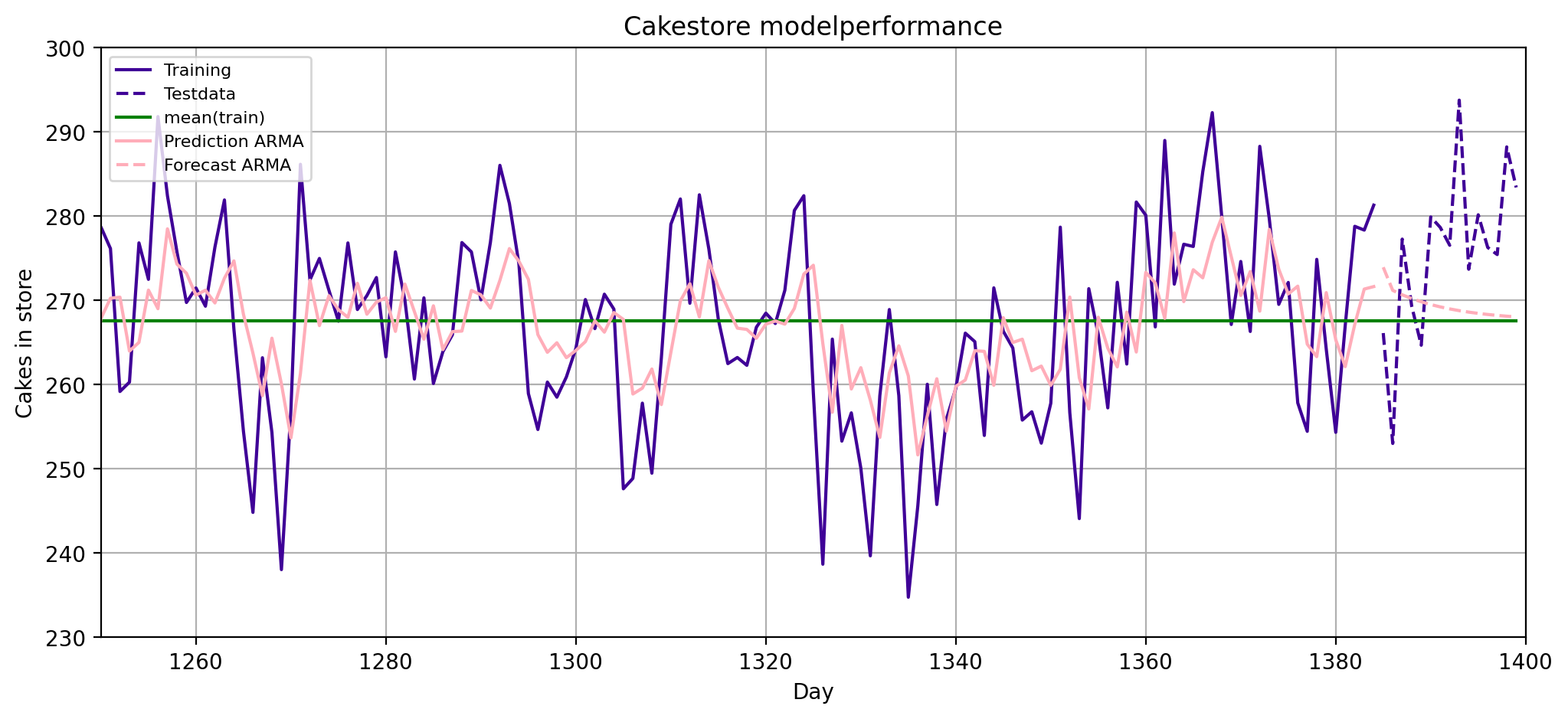

print_rmse()

Train RMSE of predict_mean: 11.32

Train RMSE of predict_ARMA: 9.88

Test RMSE of predict_mean: 12.58

Test RMSE of predict_ARMA: 12.27

\(X_t = \underbrace{0.85 X_{t-1}}_{\text{AR(1)}} \underbrace{- 0.2\varepsilon_{t-2} - 0.4\varepsilon_{t-1}}_{\text{MA(2)}} + \varepsilon_t\)

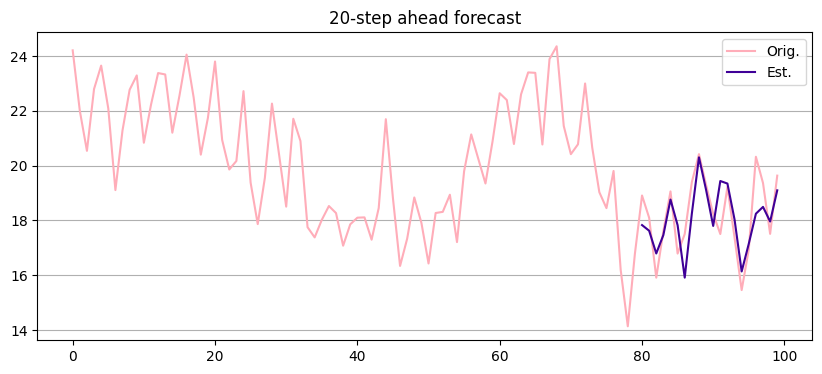

Forecasting with ARMA#

Step 1: Estimate ARMA model

get parameters

Step 2: Use parameters to forecast

calculate innovations recursively

compute forecasts with observations and innovations

software-implemented (statsmodels)

Other models from ARMA class#

ARMAX

Adding exogeneous variables to the model

ARIMA

Adding an integrated part for non-stationarity (in the mean)

SARIMA

Adding a further seasonal part to the model

ARFIMA

Models with long memory

VAR

Multivariate (vector) autoregressive models

Time-Varying coefficients

The “normal” stuff#

With a little trick you can also use many of the models we have used so far (often XGboost is working very well)

| y | |

|---|---|

| 0 | 0.496714 |

| 1 | 0.060421 |

| 2 | 0.324157 |

| 3 | 1.660069 |

| 4 | 0.209006 |

| 5 | -1.280167 |

| 6 | 1.086848 |

| 7 | 2.119192 |

| 8 | -0.510608 |

| 9 | -1.036433 |

| y | y_t1 | y_t2 | y_t3 | y_t4 | y_t5 | y_t6 | |

|---|---|---|---|---|---|---|---|

| 0 | 0.496714 | NaN | NaN | NaN | NaN | NaN | NaN |

| 1 | 0.060421 | 0.496714 | NaN | NaN | NaN | NaN | NaN |

| 2 | 0.324157 | 0.060421 | 0.496714 | NaN | NaN | NaN | NaN |

| 3 | 1.660069 | 0.324157 | 0.060421 | 0.496714 | NaN | NaN | NaN |

| 4 | 0.209006 | 1.660069 | 0.324157 | 0.060421 | 0.496714 | NaN | NaN |

| 5 | -1.280167 | 0.209006 | 1.660069 | 0.324157 | 0.060421 | 0.496714 | NaN |

| 6 | 1.086848 | -1.280167 | 0.209006 | 1.660069 | 0.324157 | 0.060421 | 0.496714 |

| 7 | 2.119192 | 1.086848 | -1.280167 | 0.209006 | 1.660069 | 0.324157 | 0.060421 |

| 8 | -0.510608 | 2.119192 | 1.086848 | -1.280167 | 0.209006 | 1.660069 | 0.324157 |

| 9 | -1.036433 | -0.510608 | 2.119192 | 1.086848 | -1.280167 | 0.209006 | 1.660069 |

The fancy stuff#

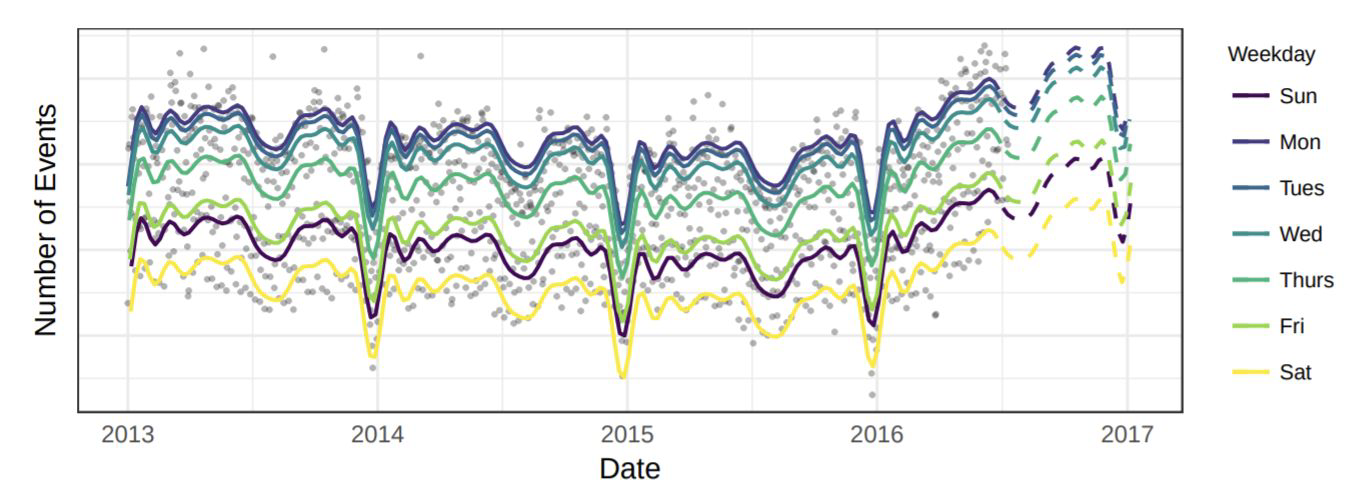

Facebook’s Prophet#

Harvey, A.C. and Peters, S. (1990), “Estimation Procedures for Structural Time Series Models” Taylor, S.J. and Letham, B. (2017), “Forecasting at Scale”

Library open-sourced for automated forecasting

Based on decomposable time series model

\(x_t = g(t) + s(t) + h(t) + \varepsilon_t\)

\(g(t)\) : trend function

\(s(t)\) : periodic changes

\(h(t)\) : holiday effects

Time is the only feature

several linear and non-linear functions of time

Needs not to be regularly spaced

Easily interpretable

Harvey, A.C. and Peters, S. (1990), “Estimation Procedures for Structural Time Series Models”

Taylor, S.J. and Letham, B. (2017), “Forecasting at Scale”

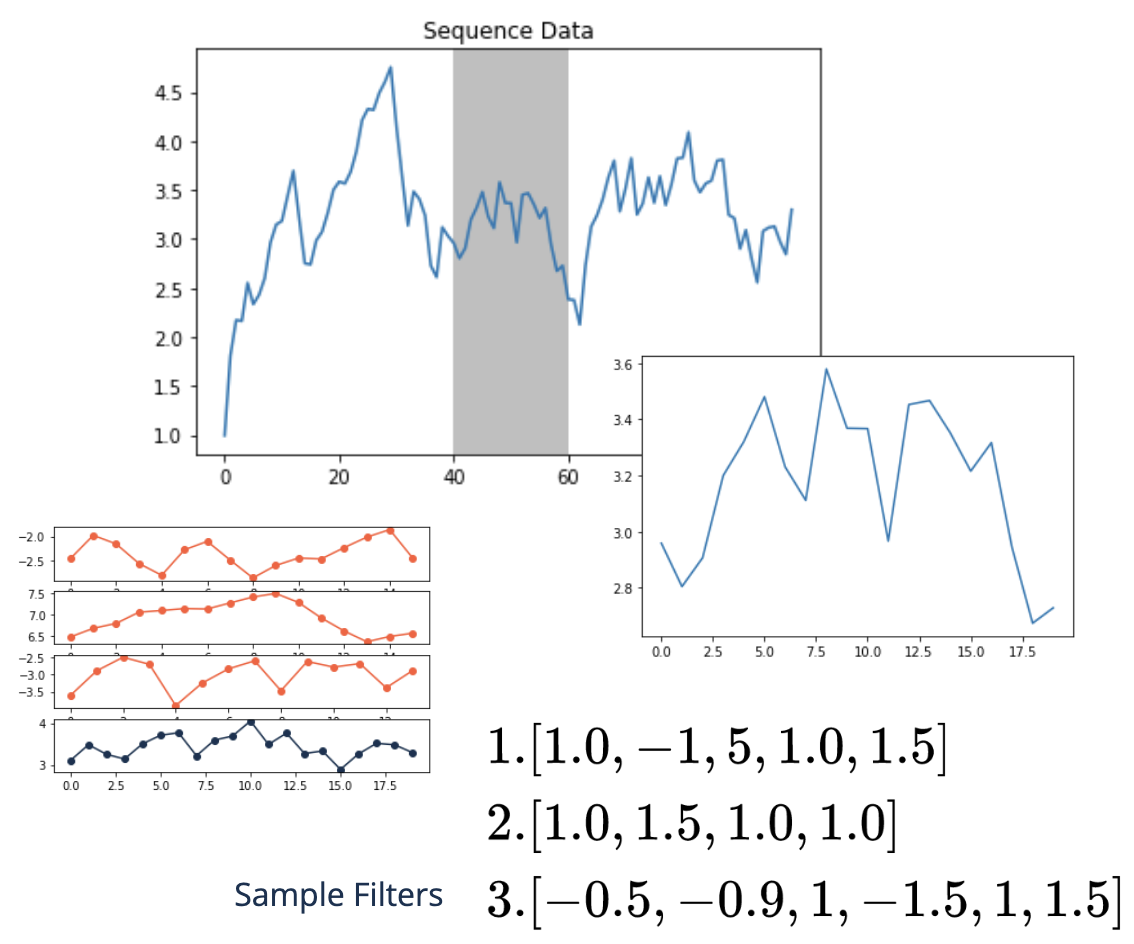

Rocket#

Open-source library for time classification

Uses CNN with >10.000 random convolutional filters

Then Logistic Regression

Exceptionally fast

1h 15min vs. 16h of alternative methods

Dempster, A. et al. (2019): “ROCKET: Exceptionally fast and accurate time series classification using random convolutional kernels”

Convolutional neural networks#

As with images slide the kernel over the sequence data to detect patterns

If the data pattern matches the filter we see spikes

Later layers in CNNs respond to more complicated patterns, i.e. higher {specialization}

In 1D-convolutions we can use longer filters or add layers

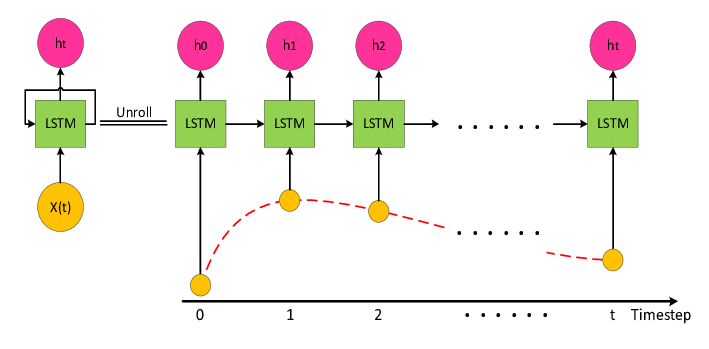

Long-Short-Term-Memory networks#

LSTMs are special network layers that carry memory for short-term and long-term information

Appropriateness ambiguous

Often do not beat exponential smoothing

Sometimes very good results

Very data hungry

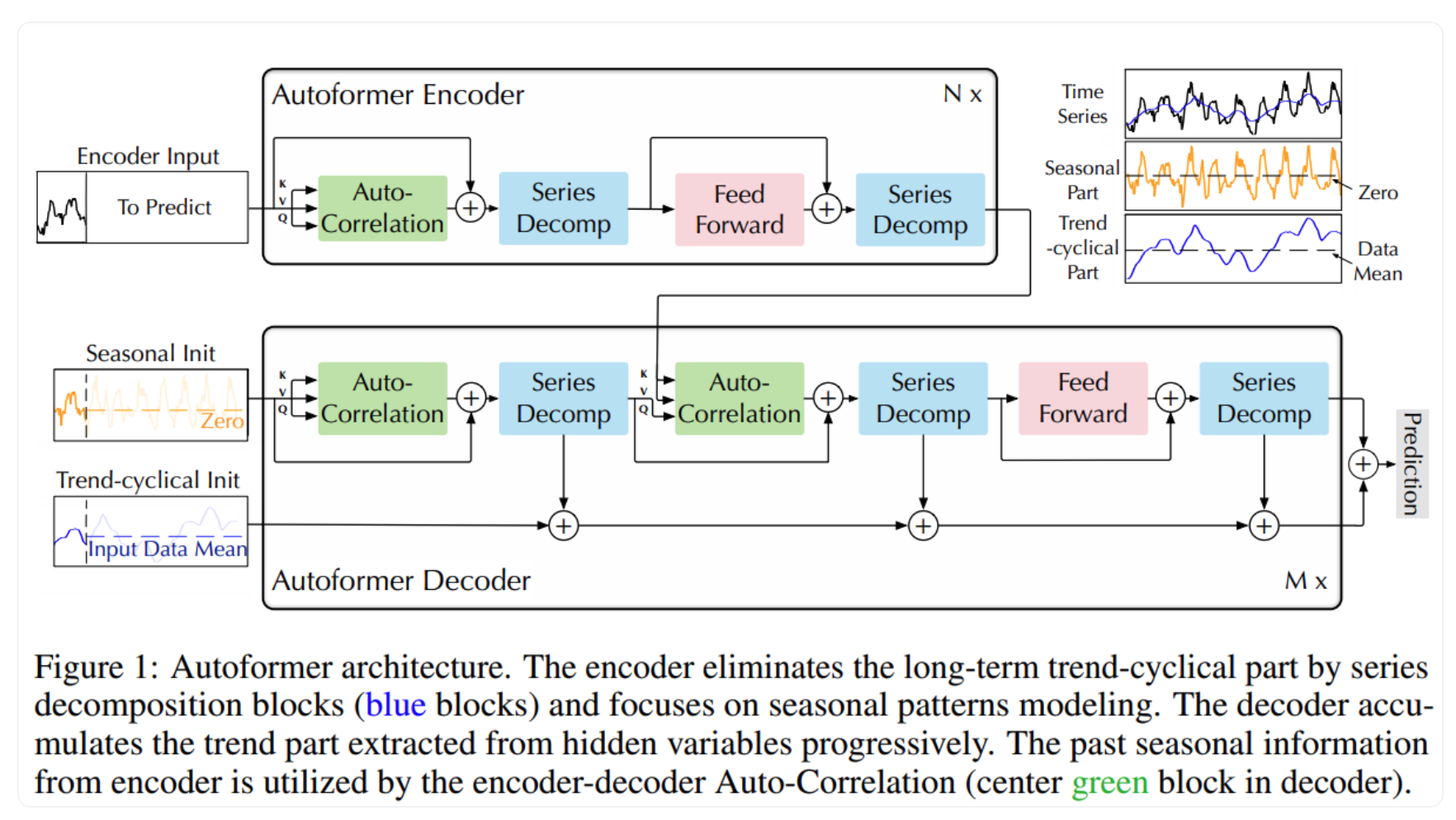

Transformer models#

A very promising model is autoformer

Good long-term predictions

Very data hungry, not much experience yet

Also, hard to predict when they will work well

Conclusion#

Many models - where to start#

As usual: with a good EDA

Find what is characteristic

Start with simple models

Exponential smoother are very good for forecasting

ARMA models are well interpretable and allow simulations and control

Only go to more complex or specific models, if you have to

and if your data amount allows you to

Resources#

Brockwell, P.J. and Davis, R.A. “Introduction to time series and forecasting”

Brockwell, P.J. and Davis, A.R. “Time Series Analysis”

Heij, C. et al., “Econometric Methods With Applications in Business and Economics”

https://machinelearningmastery.com/multi-step-time-series-forecasting/

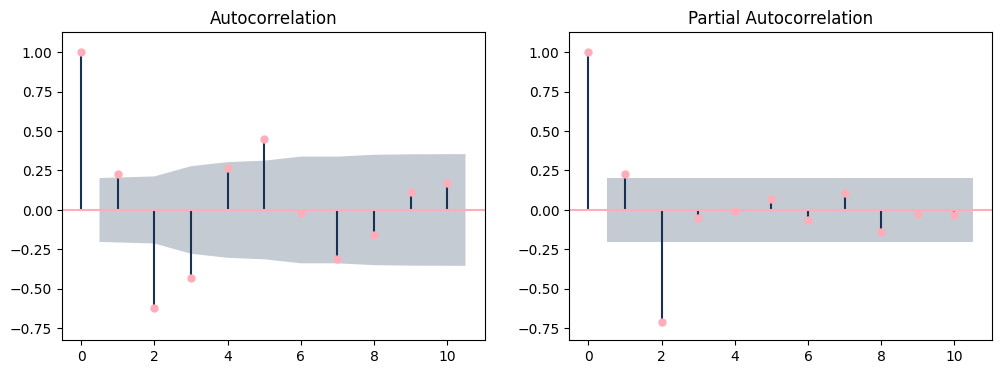

ACF / PACF#

acf_pacf(df_acf_pacf)

They all have 0/1 as a first value (auto correlation without lag. “what is the temperatur now compared with the temperatur now. wow the same, hence 1”) they have the same value for the first lag. After that, they differ.

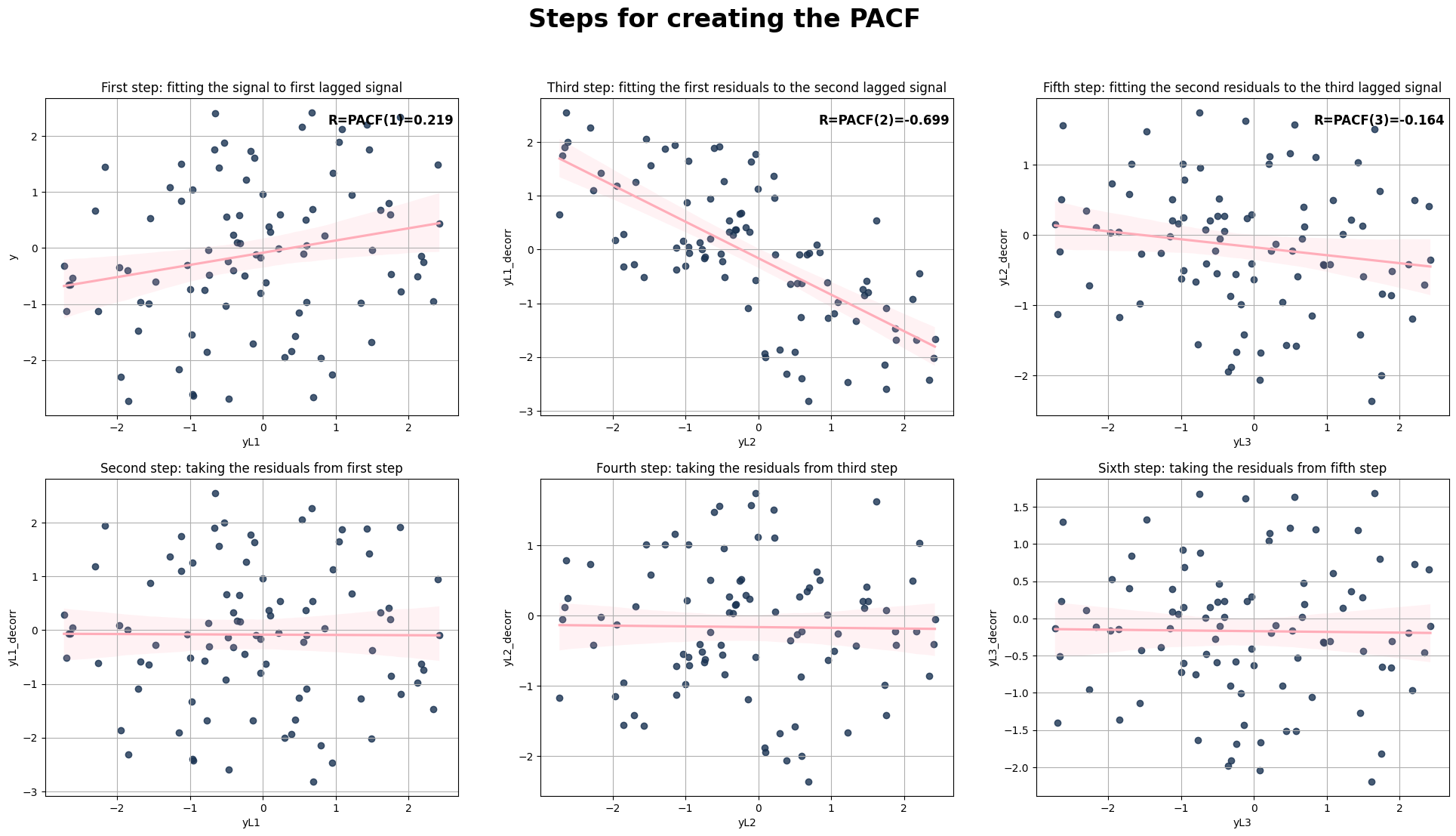

ACF / PACF#

Step - by - step visualisation to aid explaining the difference between ACF and PACF. For PACF, in each step the stuff that was already explained by the shorter autocorrelations is removed.